Getting Back to Normal

The Federal Government is now open....

The markets have treaded water during the federal government shutdown and things will begin return to normal over the next two weeks. Inflation and labor data will be much anticipated but the Fed meeting next month and the policy implications of this new information will be in the forefront of how to position for 2026.

Key Market Recap: Week of November 11-15, 2025

Market Performance

The major indices showed volatility with the S&P 500 ending the week up just 0.1% at 6,734.11, while the Nasdaq finished down 0.5% and the Dow gained 0.3%. The Nasdaq has shed roughly $1.74 trillion in market value over two weeks, down almost 3.5% in November and on track for its first losing month since March.

Government Shutdown Ends

The longest government shutdown in U.S. history ended on November 12, 2025, after 43 days when President Trump signed the funding package. The bill funds most agencies through January 30, 2026, and includes full-year funding for SNAP through September 2026.

Federal Reserve Uncertainty

Market expectations for a December rate cut have plummeted to below 50% (around 46-47%), down from 96% just a month ago. Fed Chair Jerome Powell emphasized that a December rate cut is “not a foregone conclusion—far from it,” citing strongly differing views among FOMC members.

Tech Sector Pressure

Leading tech stocks experienced significant pullbacks, with Nvidia down 10% from its late October record high, Meta down 23% since mid-August, and Palantir down 16% from its November 3rd peak. Friday saw dramatic intraday volatility with the Nasdaq briefly falling 1.9% before recovering to close up 0.13%.

Inflation Data Delayed

The government shutdown delayed nearly all federal economic data releases for September and October, including CPI, PPI, and employment reports. The most recent available inflation data shows U.S. inflation at 3.0% year-over-year in September. We will begin getting a new schedule for the Bureau of Labor and Statistics this week.

International Markets Outperforming

With annual returns of 16% through mid-November, the S&P 500 ranks 41st among more than 60 global stock indexes, marking only the third time in a decade that U.S. markets have broadly underperformed foreign markets.

Sector Rotation

Consumer discretionary was the worst-performing S&P 500 sector for the week, down more than 2%, with Williams-Sonoma leading declines with a 6% drop. Investors have been rotating out of tech stocks into other sectors, attempting to protect profits after strong gains earlier in the year.

The S&P 500 Chart

The markets have been data deprived due to the government shutdown which is likely why we have traded in a range these past three weeks. You can see the last three bars (upper right-hand corner) have stalled out below fibonacci resistance at 6975. This is likely a small consolidation period before challenging the 7000 level and if that is correct we should start to see some upward progress early next week.

However, it has been a strong rally from the April low so a larger pullback is likely in the cards in the coming months. An impulsive break of 6500 would warn of this scenario.

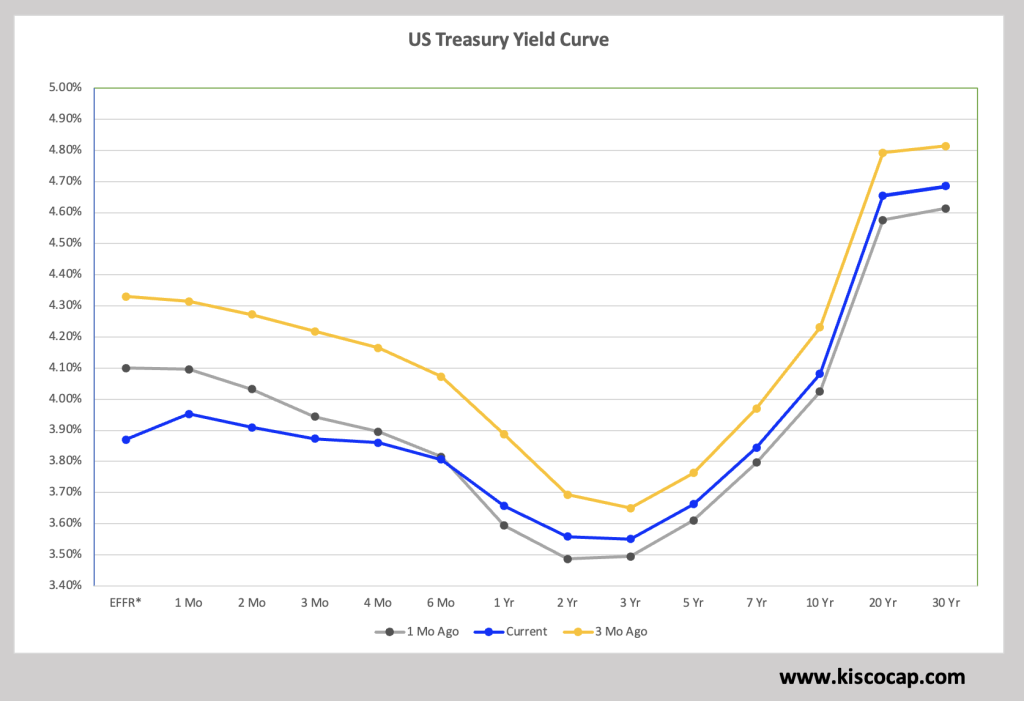

The Yield Curve

Below is the US Treasury yield curve and you can see on the left side that yields have been dropping in anticipation of further rate cuts. For now, expectations are for one more 25bp rate cut but there is risk this does not happen at the next meeting as the previous inflation data came in stubbornly above the Fed’s 2% target at 3%. Many economists have been predicting further rate cuts into 2026 but we need inflation to retreat for that to be realistic.

On the long-end of the curve (right side) we have seen 10Yr yields largely trade between 4-5% for the last three years. If inflation remains sticky, I would expect the curve to steepen and see long bonds closer to 5%. The most disruptive thing that could happen would be to see the Fed pause in December and then see the belly of the curve (5Yr) push above 4%. That would steepen the curve but make issuance harder for the weaker balance sheets in need of raising capital (more distressed companies seem to be popping up these days).

There is a lot of debt out there that needs to be refinanced in the next two years. In addition, we are seeing the large technology companies (like Meta and Oracle) begin to issue sizable amounts of bonds to raise cash for their prospective data centers so bond investors will require more yield in 2026. One thing is for sure, next year will be an interesting year for the fixed income markets!

Thank you for being a subscriber!

President, Kisco Capital